Major Currencies

Europe

British pound

British pound

Czech koruna

Czech koruna

Danish krone

Danish krone

Euro

Euro

Hungarian forint

Hungarian forint

Norwegian krone

Norwegian krone

Polish zloty

Polish zloty

Russian rouble

Russian rouble

Swedish krona

Swedish krona

Swiss franc

Swiss franc

Turkish lira

Turkish lira

Asia

Australian dollar

Australian dollar

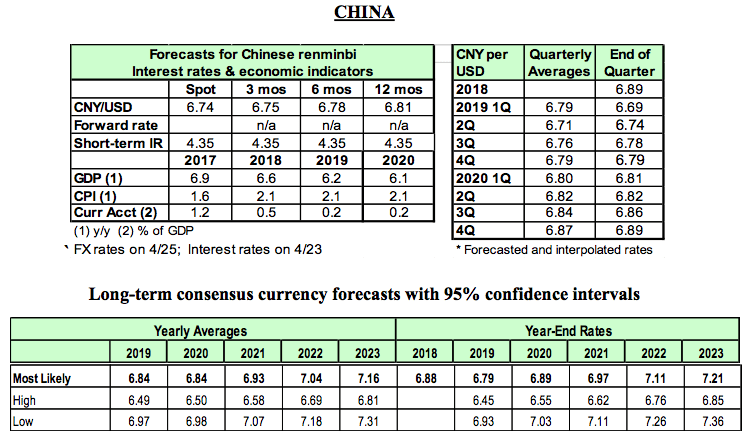

Chinese yuan

Chinese yuan

Hong Kong dollar

Hong Kong dollar

Indian rupee

Indian rupee

Indonesian rupiah

Indonesian rupiah

Japanese yen

Japanese yen

New Zealand dollar

New Zealand dollar

Philippine peso

Philippine peso

Singapore dollar

Singapore dollar

So. Korean won

So. Korean won

Taiwan dollar

Taiwan dollar

Thai baht (offshore)

Thai baht (offshore)

Americas

Argentine peso

Argentine peso

Brazilian real

Brazilian real

Canadian dollar

Canadian dollar

Chilean peso

Chilean peso

Colombian peso

Colombian peso

Mexican peso

Mexican peso

Venezuelan bolivar

Venezuelan bolivar

Other

South African rand

South African rand

Trade Weighted $

Trade Weighted $

Minor Currencies

Algerian dinar

Algerian dinar

Bahrain dinar

Bahrain dinar

Bangladesh taka

Bangladesh taka

Bolivian boliviano

Bolivian boliviano

Botswanian pula

Botswanian pula

Bulgarian lev

Bulgarian lev

Costa Rican colon

Costa Rican colon

Croatian kuna

Croatian kuna

Dominican Rep peso

Dominican Rep peso

Ecuadorian sucre

Ecuadorian sucre

Egyptian pound

Egyptian pound

Ghanaian cedi

Ghanaian cedi

Icelandic krona

Icelandic krona

Israeli sheke

Israeli sheke

Ivory Coast franc

Ivory Coast franc

Jamaican dollar

Jamaican dollar

Jordian dinar

Jordian dinar

Kazakhstan tenge

Kazakhstan tenge

Kenyan shilling

Kenyan shilling

Kuwaiti dinar

Kuwaiti dinar

Lebanese pound

Lebanese pound

Malaysian ringgit

Malaysian ringgit

Moroccan dirham

Moroccan dirham

Nigerian naira

Nigerian naira

Pakistani rupee

Pakistani rupee

Paraguayan guarani

Paraguayan guarani

Peruvian peso

Peruvian peso

Romanian leu

Romanian leu

Saudi Arabian riyal

Saudi Arabian riyal

Serbian dinar

Serbian dinar

Sri Lanka rupee

Sri Lanka rupee

Syrian pound

Syrian pound

Tanzania shilling

Tanzania shilling

Trinidad dollar

Trinidad dollar

UAE dirham

UAE dirham

Ugandese shilling

Ugandese shilling

Ukrainian hryvnia

Ukrainian hryvnia

Uruguayan peso

Uruguayan peso

Vietnamese dong

Vietnamese dong

Zambian kwacha

Zambian kwacha

Individual currency forecasts and exchange rate forecasts

Individual currencies forecasts are available upon request. You can receive a country page which includes exchange rate forecasts for 1-24 months, currency forecasts for 1-5 years, interest rate forecasts, and forecasts for growth and inflation. This gives you a comprehensive snapshot of each country and is updated monthly. China is provided as a sample.

Globally, interest in exchange rate movements has intensified as financial conditions become increasingly volatile. Investors, corporations, commercial bankers, and central bankers look for foreign exchange rate forecasts to make prudent decisions. FX4casts provides forecasts for 70 currencies on a monthly basis and is the only forecasting service that releases intra-month updates for the 30 major currencies.

Currency forecasts are used by academics in their research. The FX4casts historical database provides a 37-year period and is considered the “big data” of consensus forecasting. The database has been used by Harvard, Yale, University of Chicago, Wharton and numerous Asian and European Universities.

As shown in other sections of the website, there are many benefits to using a consensus currency forecast. FX4casts offers currency forecasts for 31 major currencies, including FOREX for the euro, FOREX for the yen, FOREX for pound, FOREX for yuan and more.

The foreign exchange rate forecast for the euro is widely viewed an indicator for developments within the EU. The currency forecast for the yen is closely linked with safe-haven currency flows. China is a big player in world trade and the exchange rate forecast for the remnimbi has become highly volatile. The exchange rate forecasts for the Canadian dollar are closely monitored as Canadian trade relations with the US exert a large influence. The exchange rate forecasts for the Australian dollar and the New Zealand dollar are largely driven by commodity prices.

In the Asian markets, much trade is conducted in USD. In other cases, the exchange rate forecasts for the Korean won, the currency forecasts for the Singapore dollar, the FOREX forecasts for the Indian rupee and the corresponding cross-rates rates are particularly useful for direct investment and foreign trade transactions.

In Latin America, the exchange rate forecast for the Mexican peso is usually denominated in USD. By contrast, for other countries, the exchange rate forecast for the Brazilian real, the currency forecast for the Colombian peso and the FOREX forecast for the Argentine peso impacts investor decision for intra-Latin American trade.

Copyright @ FX4casts LLC 2024 All rights reserved.